Six Tax Deductions You’ll Lose On Your 2018 Return

If you were hoarding receipts in a shoebox with the hope of claiming a big break on your 2018 taxes, prepare to be disappointed.

If you were hoarding receipts in a shoebox with the hope of claiming a big break on your 2018 taxes, prepare to be disappointed.

That’s because the Tax Cuts and Jobs Act placed steep limits on itemized deductions, including lesser-known breaks for the fees you pay your tax preparer and unreimbursed employee business expenses.

The new tax law also eliminated personal exemptions and nearly doubled the standard deduction to about $12,000 for singles and $24,000 for married joint filers — which will likely result in fewer people taking itemized deductions on their 2018 returns.

“The standard deduction is so high,” said Cari Weston, CPA and director of tax practice and ethics at the CPA Institute. “You might not itemize in the future if you were itemizing before.”

Here are six itemized deductions that are capped or gone altogether from your 2018 return.

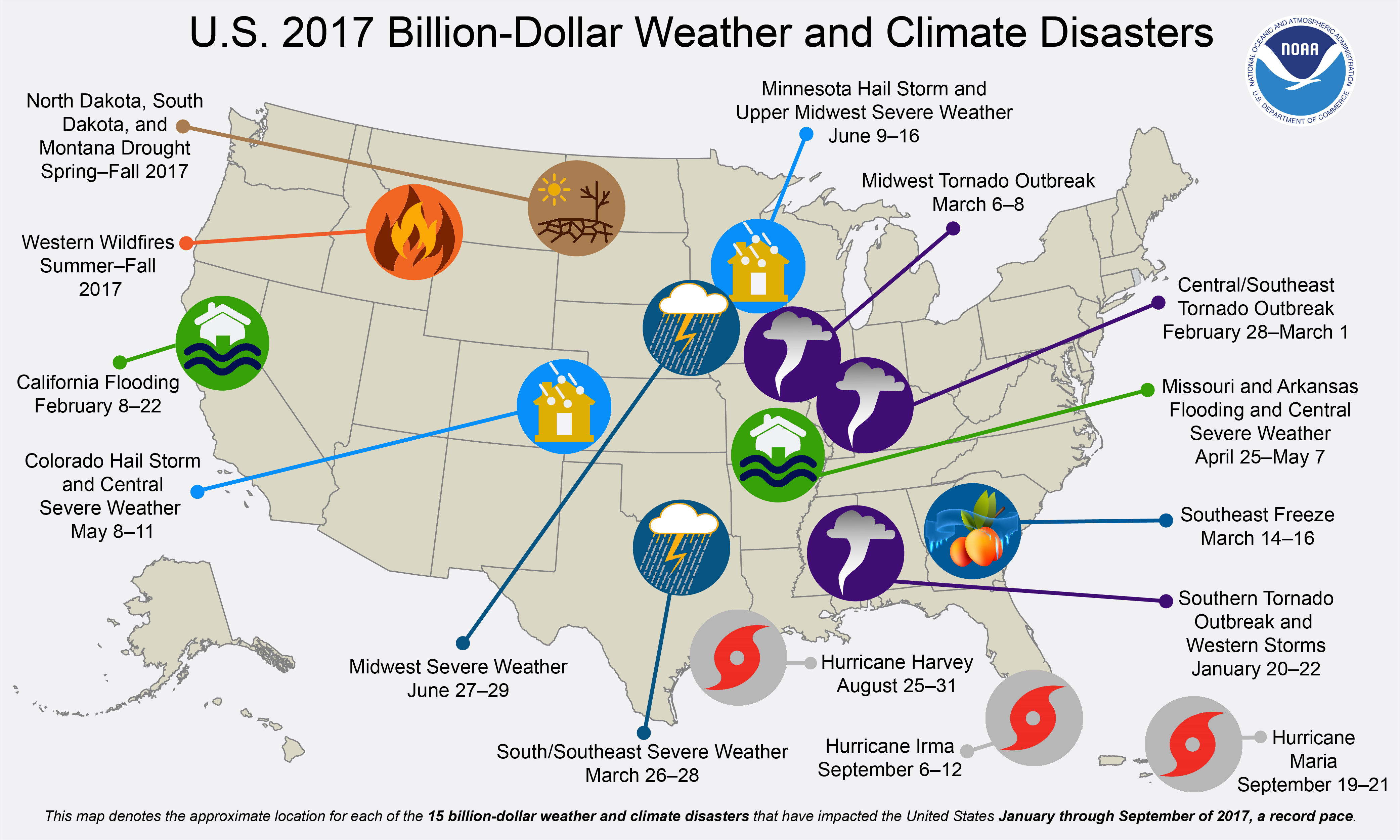

1. Casualty And Theft Losses

Winter is especially dangerous when it comes to house fires. Half of all home heating fires take place in December, January and February, according to the National Fire Protection Association.

Under the old tax code, you were able to claim an itemized deduction for property losses that aren’t reimbursed by insuranceand that occur unexpectedly. This would include damage from fire, accidents, theft and vandalism, as well as natural disasters.

You were able to deduct the losses to the extent they exceed 10 percent of your adjusted gross income.

Now, you can only claim personal casualty losses if the damage is attributable to a disaster declared by the president. This change is in effect from 2018 through the end of 2025. The 10 percent threshold of AGI still applies.

In 2016, the most recent year available, 154,274 tax returnsclaimed a casualty or theft loss deduction, according to the IRS.

2. State And Local Taxes

If you reside in New York, New Jersey or California, odds are you’re feeling the squeeze from property tax, real estate taxes, and state and local income levies.

Meanwhile, 45 states and the District of Columbia levy statewide sales taxes — and municipalities in 38 states add on a layer of local sales taxes, too, according to the Tax Foundation.

Before the tax overhaul, you were able to nab an itemized deduction — known as the state and local tax deduction or SALT — for these levies.

Kiss those breaks goodbye — at least to a certain extent. The new tax code places a $10,000 cap on SALT deductions, which could dent returns for people living in high-tax areas.

In 2015, the average SALT deduction for New Yorkers who claimed the tax break was more than $22,000, according to the Tax Policy Center.

3. Medical And Dental Expenses

The tax overhaul temporarily lowered the threshold for the medical expense deduction. For the 2017 and 2018 tax years, you’re able to claim an itemized deduction for out-of-pocket health-care costs to the extent they exceed 7.5 percent of your adjusted gross income.

Starting in 2019, that threshold will leap back up to 10 percent — where it had previously been for most taxpayers.

Bear in mind that while the IRS has lowered the bar for the amount of medical expenses you must incur in 2018, fewer people all around are likely to itemize their deductions due to the higher standard deduction. As a result, this break may no longer be available to you.

4. Tax Prep Fees And More

If you hoard receipts, you’re probably familiar with the grab bag of tax breaks, known as the miscellaneous itemized deductions.

Back in 2017, before the tax overhaul, you were able to deduct unreimbursed employee costs, tax preparation fees, investment expenses and more — as long as they exceeded 2 percent of your adjusted gross income. Under the new tax code, these breaks are out of the picture as of 2018.

5. Home Mortgage Interest

Prior to the Tax Cuts and Jobs Act, you were able to write off the interest for up to $1 million in mortgage debt. If you took out a home equity loan or line of credit, you were also able to deduct the interest paid on loans of up to $100,000.

Now you can only claim a deduction for interest on up to $750,000 in qualified residence loans — that is, the combined amount of loans you use to buy, build or substantially improve your dwelling and second home.

The IRS has also applied new restrictions to interest claimed for home equity loans and lines of credit: You can only take the break if you were using the money to build or improve your home. The deduction is off the table if you took a HELOC to use for personal expenses.

6. Charitable Giving

The IRS continues to reward taxpayers with philanthropic inclinations — as long as they give generously. The charitable donation deduction is still on the table, even after the tax overhaul. The only difference now is how many people will be able to claim it.

A combination of higher standard deductions and limitations on itemized deductions means that fewer people will be itemizing on their 2018 returns. In turn, that could put the charitable deduction out of reach for those taxpayers.

If you fall just short of the new standard deduction of $12,000 (single) or $24,000 (married and filing jointly), you might be able to itemize in 2018 if you “bunch” multiple years of charitable donations and get over the hurdle.

Source: CNBC