This Type Of Loan Doesn’t Help Your Credit Score, Even If You Stay On Top Of It

Paying down a loan on time is a good way to build a positive credit history and improve your credit score. But those using a payday loan shouldn’t expect any good marks in their credit file if they pay on time.

Paying down a loan on time is a good way to build a positive credit history and improve your credit score. But those using a payday loan shouldn’t expect any good marks in their credit file if they pay on time.

Also called cash advances, payday loans are typically small loans you can get in most states by walking into a store with a valid ID, proof of income and a bank account. The balance of the loan, along with the “finance charge” (service fees and interest), is typically due two weeks later, on your next payday.

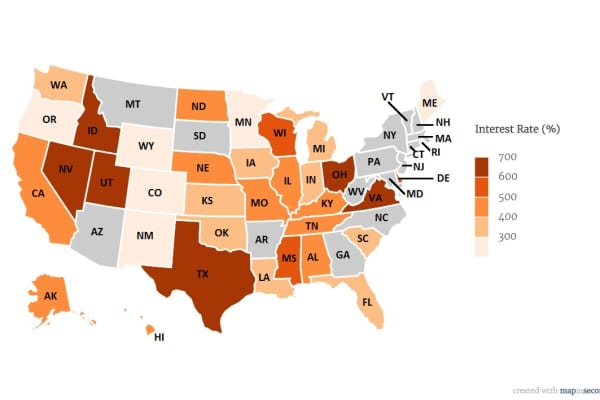

But these types of loans come with major drawbacks. First and foremost, they are extremely expensive: The national average annual percentage rate (APR) for a payday loan is almost 400 percent. That’s more than 20 times the average credit card interest rate.

Even if you do manage to stay on top of these loans, payday loans are considered “single repayment” loans and typically are not reported to mainstream consumer credit bureaus like Experian and TransUnion, according to the economic and social policy research non-profit Urban Institute. So if you pay off your loan on time, it doesn’t count toward your credit history.

“Payday loans are not reported to the credit reporting agencies so it would be a systemic impossibility for them to have a direct impact (good or bad) on your credit scores,” credit expert John Ulzheimer tells CNBC Make It.

Busting The Myth

Payday loans helping your credit history is a popular misconception, according to the Urban Institute. So much so, the organization included it in a newly released fact sheet released on credit myths. Rather than using payday loans to try and build good credit, experts say these types of loans should be avoided entirely.

“Payday lenders are sharks,” Michelle Singletary, a personal finance expert and columnist, said during a recently held Urban Institute panel discussion. “Payday loans are a horrible business model for most people.”

The Consumer Financial Protection Bureau found that nearly one in four payday loans are re-borrowed nine times or more, while Pew found it generally takes borrowers roughly five months to pay off the loans and an average of $520 in finance charges.

“It’s normal to get caught in a payday loan because that’s the only way the business model works,” Nick Bourke, director of consumer finance at Pew Charitable Trusts, tells CNBC Make It. “A lender isn’t profitable until the customer has renewed or re-borrowed the loan somewhere between four and eight times.”

So why are people using these types of loans?

“Convenience,” says Brenda Palms-Barber, the executive director of Chicago non-profit North Lawndale Employment Network. “The convenience is number one.”

Across the U.S., there are approximately 23,000 payday lenders, almost twice the number of McDonald’s restaurants. For example, in a state like Ohio (which has the highest payday loan APR in the country), there are more than double the number of lenders than there are places to get a Big Mac.

Meanwhile, more than half (51 percent) of millennials say they’ve strongly considered using these risky loans. The most common reason? To cover basic living expenses such as groceries, rent and utilities, the survey found.

Building Credit The Smart Way

Like payday loans, your income and savings are not factored into your score. Instead, credit scores are based on the products you use, such as a credit card or a home mortgage. Monthly bills like your telephone, utilities and cable also are typically left off your score. So simply paying your bills on time is not a guarantee you’ll have a good score.

Your credit score really depends largely on how much credit you use and how you manage it. To build your credit score, you need to pay at least the minimum balance due — and pay it on time.

The Urban Institute finds that the number of credit cards someone holds doesn’t make a big difference on someone’s score. Yes, getting a new credit card or car loan can trigger a hard inquiry, a credit check pulled by a financial institution that can lower a score. But an inquiry typically only lowers your score by five to 10 points for a few months, according to experts. And if you’re shopping for a good interest rate on things like mortgages, all inquiries made within a 45-day period count as a single inquiry.

One critical factor in building and maintaining a good credit score is keeping your spending in check. The amount spent on your credit cards at any given time should always stay below 30 percent of your total limit, according to the Urban Institute. You don’t need to carry an ongoing balance on the card either to achieve this. Buy what you can afford and plan to pay off your credit card on a monthly basis.

Source: CNBC