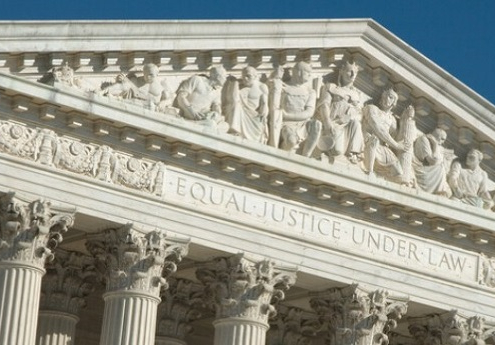

Key Things To Know As Supreme Court Nears Decision On Biden’s Student Loan Forgiveness

If the justices greenlight President Joe Biden’s relief, many borrowers will immediately get $20,000 of their student debt cancelled – if they’d received a Pell Grant in college, a type of aid available to low-income families – and as much as $10,000 if they didn’t.

This One-Time Strategy Can Waive IRS Tax Penalties. ‘It’s Like A Get Out Of Jail Free Card,’ Expert Says

Described like a 'Get Out Of Jail Free Card', this lesser-known first-time penalty abatement may waive IRS fees in certain situations, tax pros say. However, there are specific IRS guidelines to qualify for penalty relief.

How To Prepare For The Return Of Student Loan Payments

The agreement negotiated between President Biden and House Speaker Kevin McCarthy to raise the debt ceiling stipulates that student loan payments would resume around Sept. 1, Since many people have gone three years without factoring student loan payments into their budgets, and the change could be jarring.

What Happens If You Amend Your Tax Return?

Taxpayers may need to file an amended return if they discover that they made mistakes, such as failing to report income, claiming deductions or credits incorrectly, or making other errors that affect the amount of tax owed or the amount of refund due.

Time To Say Goodbye To Income Taxes? Examining The National Consumption Tax

The FairTax Act of 2023 proposes replacing current taxes with a national consumption tax.

How To Set Up A Payment Plan With The IRS

Wondering if it's still possible to arrange a payment agreement with the IRS before the 2023 tax deadline? The answer is yes. giving a taxpayer the opportunity to pay their taxes on a timeframe set by the government, saving them from penalties and other fees.