Here’s Why Getting Exactly ‘Zero’ Back From The IRS Might Be A Good Thing

Forget about that gigantic refund: What you really want from the IRS is a tax balance of exactly zero and no big check.

Forget about that gigantic refund: What you really want from the IRS is a tax balance of exactly zero and no big check.

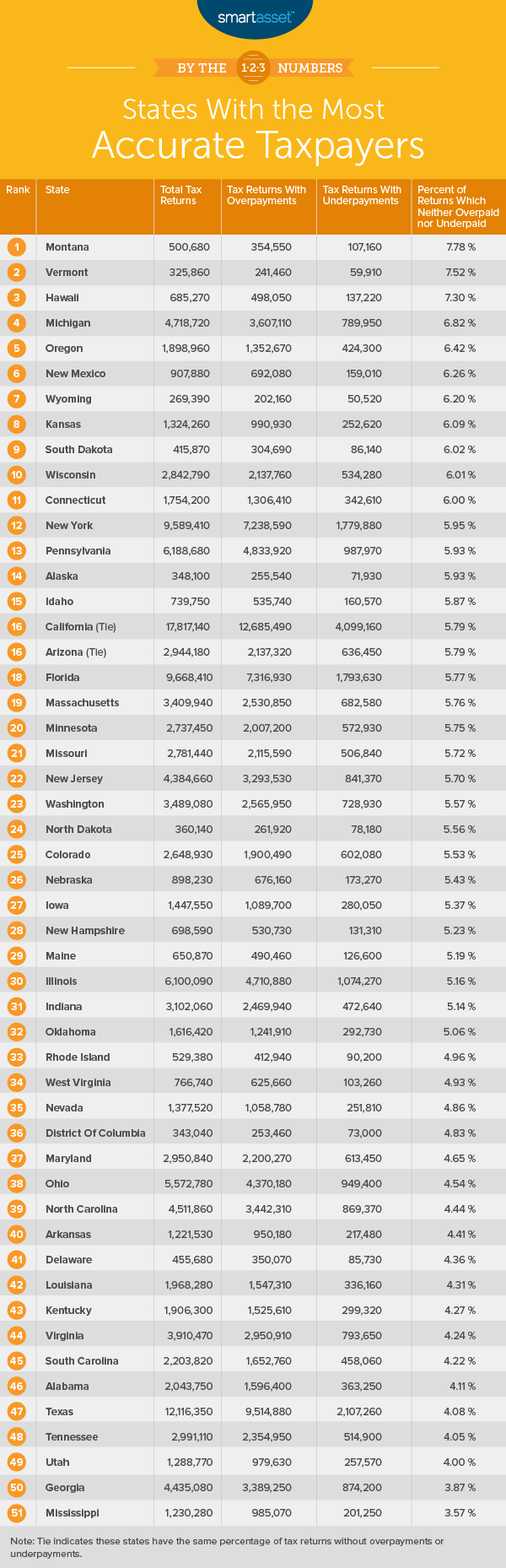

That’s because hitting zero with the taxman — that is, neither owing a balance nor receiving a refund — is an indication that you paid exactly the amount of tax liability you owed. A select group of taxpayers managed to hit that goal during the 2016 tax year, according to SmartAsset’s analysis of IRS data.

Montana happens to be home to the greatest number of filers who owed nothing and received nothing in return from the IRS. Indeed, 7.78 percent of returns from residents in that state showed that they exactly paid their liability, the personal finance website found. About 70 percent of 500,680 federal tax returns filed by Montana residents overpaid their 2016 taxes, which would have made them eligible for a refund.

“People think about not getting a refund as a failure,” said AJ Smith, vice president of financial education at SmartAsset. “If you can make it so that you don’t owe money or you get money back, you’re paying the right amount of taxes throughout the year — and you have money in your hand to do what you want with it.”

Vermont and Hawaii rounded out the top three states with the greatest proportion of taxpayers who nailed their tax liability on the head in 2016.

Go For Zero

This tax season has been an eye-opener for filers. It marks the first time people are submitting their returns under the Tax Cuts and Jobs Act, an overhaul of the tax code that went into effect in 2018.

Major changes from the new law include a higher standard deduction ($12,000 for singles and $24,000 for married joint filers in 2018), the elimination of personal exemptions and new limits placed on itemized deductions, including a new $10,000 cap on state and local deductions.

The IRS and Treasury also released new withholding tables, which are the guidelines that your employer follows in order to deduct the appropriate amount of income tax from your paycheck.

As a result, some filers are grappling with some surprises after filing their 2018 returns, including smaller-than-expected tax refunds or levies owed from last year. Smaller refunds aren’t necessarily a bad thing: It may mean that you kept more of your own cash instead of overpaying the IRS.

“It can feel nice to get a chunk of change, but that’s your money that you didn’t have throughout the year,” Smith said.

If you’ve filed your taxes and you’re unhappy with the results, take a look at your tax liability and think about what you can do to adjust it. That might mean reviewing your Form W-4, which your employer uses alongside the withholding tables to help pinpoint your income tax load.

If you claim too many allowances on your W-4, you will withhold less tax from your pay – but you may owe the following year. If you claim zero allowances, you may overpay the IRS, but you’ll bring home less pay. Further, if you have additional sources of income — say from freelance work — you may need to evaluate how much you’re paying in taxes each quarter to make sure you get the liability just right.

See below for SmartAsset’s ranking list of states whose taxpayers managed to pay exactly what they owed during 2016.

Source: CNBC