Child Tax Credit: Advocates Propose New Way To Expand Monthly Payments For Parents

When Congress passed the American Rescue Plan last spring, the maximum Child Tax Credit (CTC) amount was temporarily raised through the end of 2021.

When Congress passed the American Rescue Plan last spring, the maximum Child Tax Credit (CTC) amount was temporarily raised through the end of 2021.

Parents also had the option to receive the credit in monthly advance payments instead of in a lump sum during tax season. As a result, millions of families received up to $300 per child each month between July and December 2021.

But this legislation wasn’t renewed in 2022, which means that eligible households have not received CTC payments this year so far. The Center on Budget and Policy Priorities (CBPP) previously reported that making the expanded CTC permanent would reduce childhood poverty, but lawmakers haven’t yet continued the expanded credit.

To make up for the lack in federal benefits, CBPP policy analysts are urging state governments to create their own child tax credits. They said that state-funded CTCs can effectively “target tax reductions to people and communities that could most use the help.”

Which states have already implemented child tax credits? How do you manage your finances if you’re not eligible for the CTC expansion. One method is to consolidate higher-interest debt into a fixed-rate personal loan.

As Federal Benefit Expires, Some States Offer Their Own Child Tax Credits

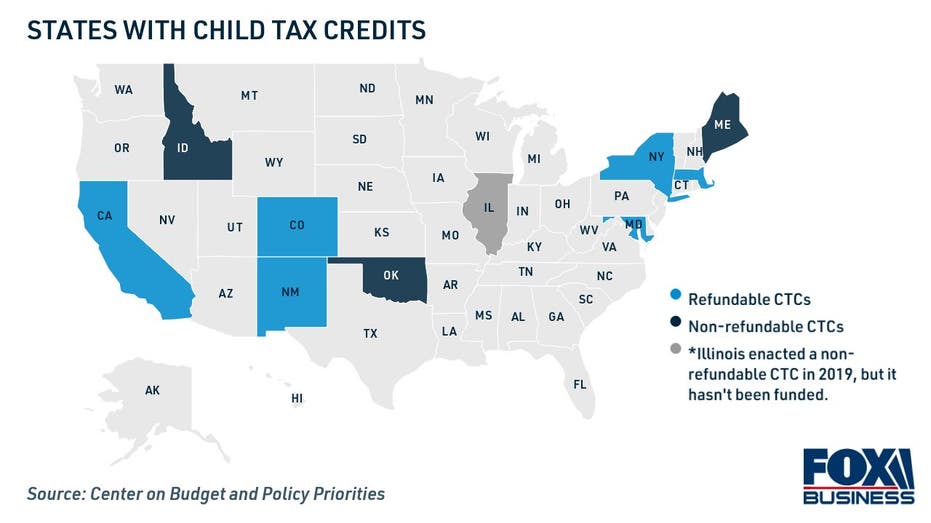

The expanded federal child tax credit — including the monthly CTC payments — expired at the end of 2021. While the CBPP urges state legislatures to implement their own CTC expansions, nine states have already done so. You can see which states have child tax credits on the map below:

CTC eligibility requirements vary by state — for example, California’s Young Child Tax Credit is available to working families who have a child under 6 years old and qualify for the state’s Earned Income Tax Credit (EITC). The Massachusetts Household Dependent Tax Credit is available to elderly and disabled dependents, as well as children.

Lawmakers in some other states, including Michigan and Oregon, have recently introduced legislation to create a new child tax credit. Additionally, the New York state legislature recently increased funding to the Empire State Child Tax Credit Program, which was established in 2006.

Still, taxpayers in the vast majority of states don’t have access to these CTC benefits.

If you’re looking for ways to cut expenses after the federal CTC payments expired, you might consider credit card consolidation. Paying off revolving credit card balances with a personal loan has the potential to save some borrowers thousands of dollars in interest charges over time.

State CTCs May Reduce Child Poverty And Boost Local Economies

CBPP research shows that enhanced child tax credits can help eligible families afford basic needs like groceries, utilities and rent while lifting millions of American children out of poverty. Cash supports “like the CTC” are associated with improved child development and educational outcome, too.

Not only can tax credits give low-income families the financial tools they need to support their children — more money in parents’ pockets often translates to higher participation in local and state economies. Plus, CBPP policy analysts said the expense of funding CTC programs is relatively insignificant in a state’s budget.

“The costs of enacting or improving existing credits are also typically small enough that states may be able to absorb them without raising additional revenue,” the authors wrote.

However, these tax credits are only beneficial to households in certain parts of the United States. Families who live in states without CTC programs may need to look for other ways to cut expenses, such as consolidating debt into a fixed-rate personal loan.

Source: Fox Business