The Very Best Apps for Saving Money Effortlessly

Honestly it’s pretty annoying since it requires a delicate amount of personal control and the temporary surrendering of your cash. But don’t worry, your computerphone can help.

There’s now a small cottage industry of apps that essentially do the work of saving—and even investing—for you. None of them are perfect. In fact, some of them will actually make you lose money sometimes.

These free apps are, nevertheless, better than nothing if you use them wisely. After about a year of testing out over a dozen savings apps, here are some favorites. Here’s a guide to help you save money and avoid anxiety attacks.

Digit

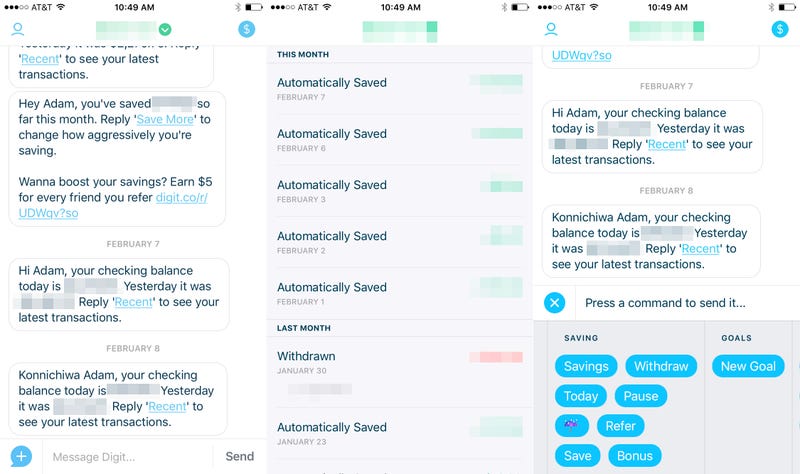

Digit actually started out as a text message-based service that would connect to you bank account and use some artificial intelligence to make small withdrawals based on your balance. If you’ve got a lot of money in your account, the service takes out a few bucks a day. If you’re broke, it’ll be a few cents.

Digit is now a full-fledged app, but the basic premise remains the same. You can send commands through the app or via text to save more, deposit money into savings, or send cash back to your bank account. The app also makes little withdrawals so that you keep saving without any effort. You can also get daily texts reminding you how much money you have in your account and, henceforth, how far away payday feels. [iOS, Android]

Acorns

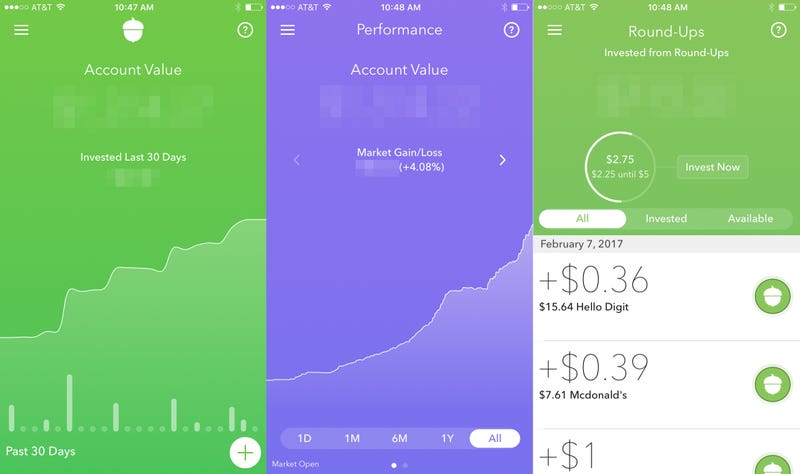

Full disclosure: Acorns is a favorite. The app not only saves when you’re not looking with a stupid simple feature that rounds your purchases up to the next dollar and saves the extra pennies in your Acorns account. Some banks do this, too, but Acorns actually invests those pennies in financial products like stocks and bonds. I’m currently enjoying gains of over 4 percent on those little investments, and it feels like free money.

You can also set up recurring deposits through Acorns and set aside, say, $20 a week that will also get invested. These small deposits add up quickly, and the fact that you’re actually investing the money means that your balance will climb nicely without much effort. Then again, you always run the risk of a crappy market chipping away at that balance. [iOS, Android]

Stash

This is where the savings-versus-investing line starts to blur. Stash works a bit like Acorns insofar as the app let’s you set up regular deposits and easily invest that money in stocks and bonds. There’s no round up feature, unfortunately, and it takes a little bit more effort to pick your investments, since Stash lets you choose between packages like “Roll With Buffet” or “Slow and Steady.” If you don’t know about investing, there are some little tutorials to help.

All that said, the effort does pay off. The Stash account of Adam Clark Estes is currently up a little more than one percent which is not quite hedge fund money, but it’s still slightly better than your average savings account. Stash also lets you project your gains based on how much you’re depositing which makes you feel closer to death but also optimistic about retirement. [iOS, Android]

Betterment

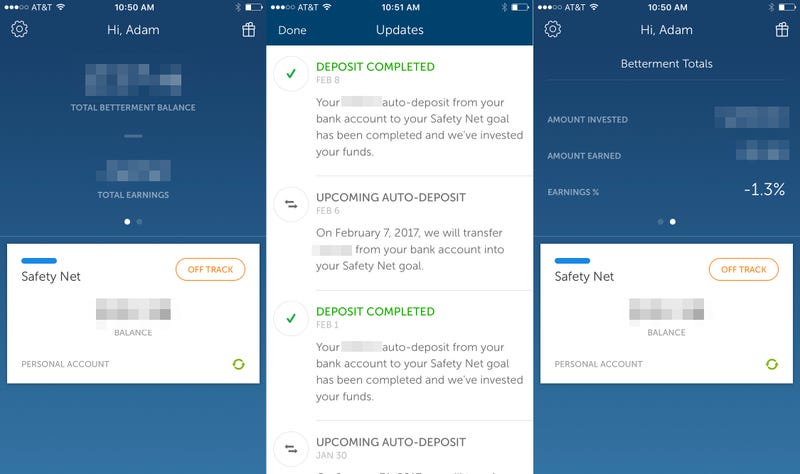

If you’re trying to save and invest a whole lot of money, Betterment appears to be the app for you. It’s a self-described investment and wealth management service, so if you try to use Betterment the same way you use Acorns and Stash, you’re gonna get boned.

Adam Clark Estes deposited a few dozen bucks into a Betterment account, and as a result, actually lost a handful of bucks. This seems to be the result of paying fees for a service he didn’t use very aggressively. To be specific he was down a little over 1 percent—which isn’t the worst thing in the world since he saved a bunch of money instead of spending it on beer and vintage sneakers. Betterment also charges a 0.25-percent annual fee that gets hiked up to 0.40-percent if you opt in the Betterment’s personal financial advisor service (and carry a balance of $100,000 or more). If you’re carrying a balance of that size, though, please stop reading this blog, and take a bath in gold coins. [iOS, Android]

Qapital

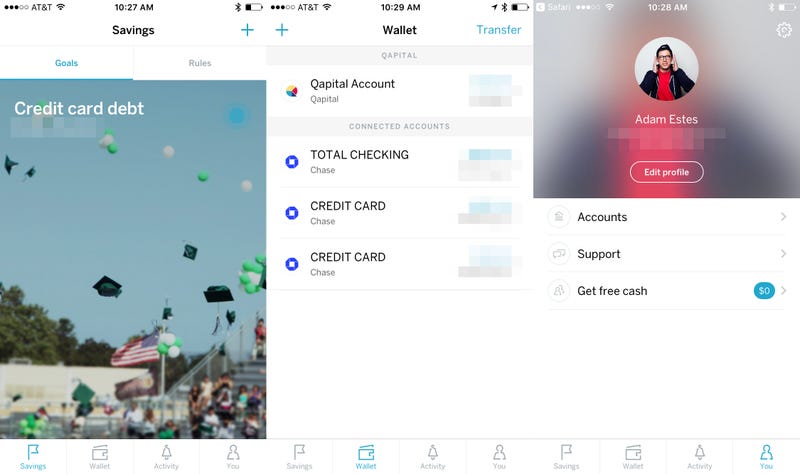

Despite its objectively bad name, Qapital is one of the more interest (and confusing) automated savings apps. Much like Acorns, you can set it up so that Qapital rounds up purchases to the nearest dollar and saves the difference. You can also assign certain rules so that you deposit money to Qapital when you shop at certain stores, get your paycheck, or make big purchases. You may prefer a simpler approach, but extra options are always fun.

Another perk you can create savings goals and share them with friends. So if you and your best bud wants to save up for a clubbing trip in Berlin (no judgment), you can both make deposits into that account through Qapital. The app also offers some neat IFFT features that let you create recipes that save money when you do certain things, like check in on Foursquare or tweet something dumb. This is a good way to learn how to stop tweeting dumb stuff. [iOS, Android]

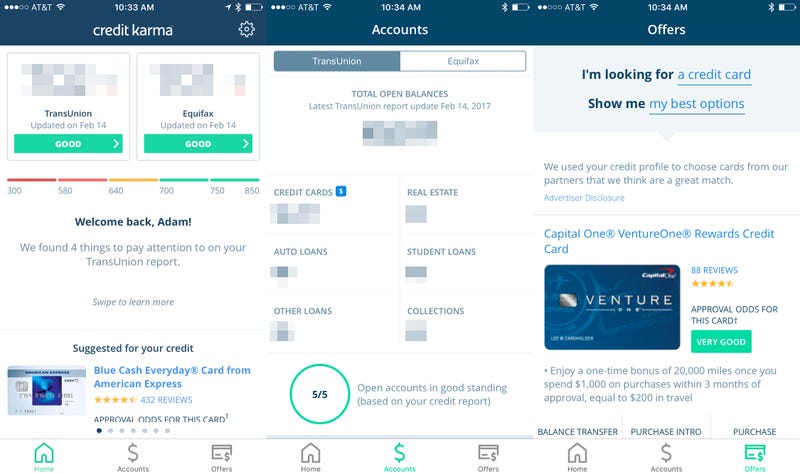

Credit Karma

This is not a savings app, but if you care at all about your personal finance, you should download Credit Karma. The premise is simple: you can keep an eye on your credit score, and the app will tell you how to improve it. Credit Karma will also tell you if you have outstanding accounts, which is very handy when you’re trying to avoid late fees or delinquencies. After all, saving money is all about not spending money you don’t need to spend.

Just don’t sign up for any new credit cards. That’s a terrible way to save money.

Source: Gizmodo